Before you can understand why you might want to stake. Let me first give a short introduction on how Cardano differs from most cryptocurrencies.

Proof-of-Work

Cardano, unlike other networks like Bitcoin, Ethereum, and Monero, runs on a Proof-of-Stake algorithm. Proof-of-Work involves throwing massive amounts of computing power at complex mathematical problems in hopes of finding a block. Whenever one of the problems is solved, the miner can make a block on the blockchain that contains pending transactions. If no blocks are found for some time, transactions can be delayed. This method is called Proof-of-Work and you need a lot of expensive hardware and electricity to make any profits.

If there is congestion, transactions made with a higher fee are treated with higher priority, which can cause further delays.

Proof-of-Stake

Proof-of-Stake relies on currency being held for determining who gets to make blocks. Blocks are made in an organized fashion, every few seconds. Blocks are made by Cardano Stake Pools. A stake pool contains one or more wallets that have ADA (₳) in them. These are the Stake Pool owners. For minting blocks, Stake Pool owners are rewarded with fees.

Who can run Stake Pools?

Anyone can run a Cardano Stake Pool! However, it will cost time, technical knowhow, servers, effort and a little bit of ADA to get started. For most people not familiar with maintaining Linux systems this is probably not do-able.

Leader selection

Near the end of an epoch, the leader log for the next epoch is calculated. This will determine which pools get to make blocks. Stake Pools are selected to mint blocks (being a leader) based on a formula that takes several things into account. Without going into too much detail, it is very much a lottery. The more ADA the owners of the pool have in their wallets, the more lottery tickets it holds. So more ADA in the pool will lead to higher chances for minting blocks.

Delegating

Not everyone will want to run a Stake Pool, which is where delegation comes in. You can participate in a Stake Pool by delegating your ADA to a Stake Pool.

In order to delegate, you will need your own wallet, you can do this with Yoroi wallet or Daedalus wallet. A common misunderstanding is that the ADA leaves your wallet if you delegate to a pool, but with staking in Cardano the ADA never leaves your wallet!

What does happen when you delegate to a Stake Pool, is that you are in fact giving off a certificate that says:

“The ADA in my wallet can be used for the lottery in determining which pools get to mint blocks next epoch.”

Nothing more, nothing less, your ADA is always safe. Even if the Stake Pool ceases to exist. You pay a small fee initially for delegating, around 12 ₳. If you wish to redelegate to another pool, that will cost around 2 ₳. If you wish to further make trades with your ADA, you can choose to do that after an epoch has started. Just make sure you leave about 10 ADA in the wallet, some websites that track pool stats do not account for empty wallets. Making it harder to track your rewards there, if you want to.

Benefits of staking

Stake Pools that mint blocks are rewarded for every block they make. Stake Pools determine how much of these rewards they will keep. They set a fee for every epoch (5 days) which they will always get first. The minimum for this allowed by the Cardano network is 340₳. Apart from that they set a variable rate, from 0 to 100%, for the remainder of the rewards that the Stake Pool will be awarded. This remainder is what is distributed to everyone who delegated to the Stake Pool. This is done by the network, and Stake Pools cannot cheat you in this process.

For a Stake Pool that is not over-saturated, the annual return of ₳ is about 5% per year. This is why staking pays off. A lot of exchanges will also stake ADA, but might not reward you for it.

Selecting a pool

As stated above, the variable fee is what influences your rewards. It is possible for a pool to set the fee to 100%. This means the Stake Pool owners will get ALL of the rewards and you get nothing. These pools are considered private pools. You can still join them, but you will not get any rewards. Most wallets in those pools simply belong to the same owner.

Most pools have a variable fee of around 0 to 5%, and this difference in percentage does not really matter much in terms of rewards. You can look for pools on adapools.org. You should watch out for pools with a fixed cost much higher than 340 ₳. Apart from that it does not really matter if the pool currently has 2 million ₳ or 50 million ₳ in it. As long as the pool is minting blocks and running fine, you get the same rewards on average.

Saturation

Above 62 million ₳ rewards are capped and the pool is deemed fully saturated. This is done to prevent pools from becoming too large and having too much influence.

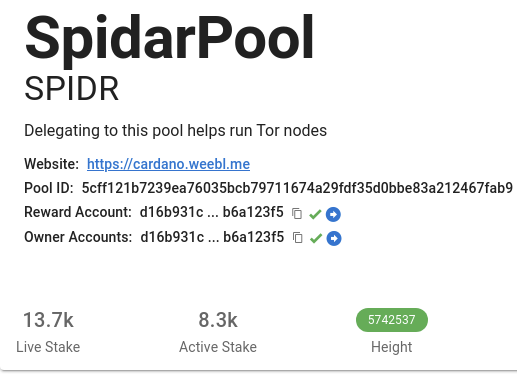

Find a pool with a variable fee of 0 to 5% that might have a purpose that speaks to you. The SPIDR pool aims to strengthen digital privacy by using part of the rewards to help strengthen the Tor network. Since the SPIDR pool is still starting out, block minting will not happen every epoch currently.

You are of course very welcome to to stake with the SPIDR pool! I am very committed keeping this pool healthy. Decentralization is key to Cardano’s success.

If you do not plan on staking for a while, you should choose a larger pool which is making blocks every epoch. If you stake with SPIDR currently, rewards will take a while to come. The rewards all even out in the long run though!

Is that it?

Sort of.

The Cardano network makes sure pools cannot cheat you out of rewards that belong to you. However, a pool can decide to change their fees for a next epoch. These changes never apply to the current epoch, but it is good practice to have a look at your pool’s fees from time to time. Especially before a new epoch is about to begin.

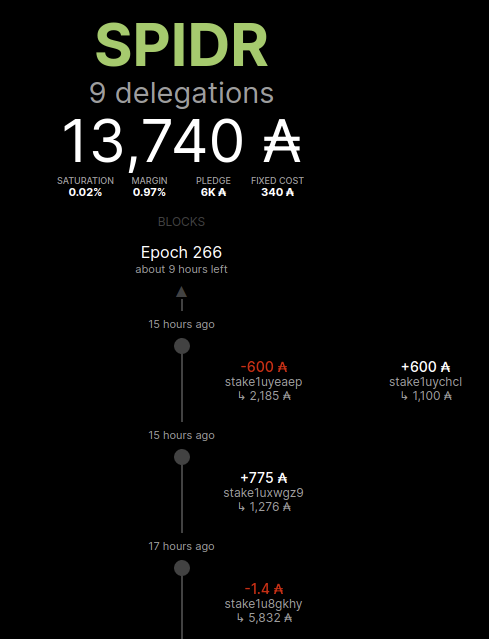

On pool.pm you can see a nice view of all changes that happen in a Stake Pool. Example:

Is my chosen pool healthy?

Apart from looking out for pools that might change fees to their benefit, it is good practice to also check the overall healthiness of your chosen Stake Pool. A Stake Pool Operator (SPO) might not have bad intentions, but there are some periodic actions an SPO has to undertake to keep the pool in running order.

pooltool.io

A good indicator for health in general is if it is creating blocks. If you consider delegating to pools that are not making blocks regularly, since the amount of ADA delegated to the pool is still low, you can get a good impression of their health by checking pooltool.io.

It is possible for a Stake Pool Operator to export some data to pooltool.io, such as current “block height”. In order to mint blocks, the Stake Pool should always have the latest view of the pending transactions. This is indicated by the block height. A block height that is behind the most recent block indicates something is wrong!

If the block height is green, that means the Stake Pool is up to date on the state of the network.

If no block height is reported, that means that Stake Pool does not integrate with pooltool.io, which is completely optional. The pool could very well be in good running order. Correct block height on pooltool.io just adds a little bit of insight into the Stake Pool’s operation.

adapools.org

There is also a page on adapools.org that will show potential problems with pools. Such as pools that are expected to make a lot of blocks since they have a large amount of ADA in the pool, but are not actually making the amount of blocks expected.

You can view that page here.

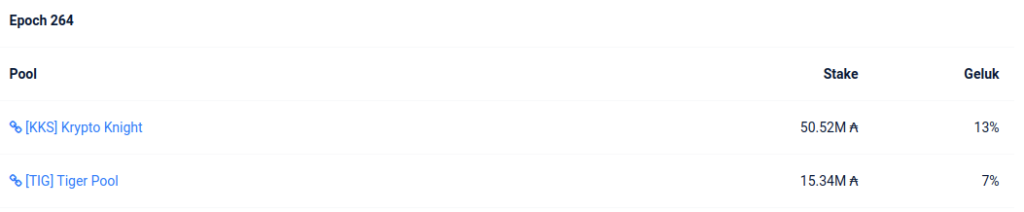

As an example, these two pools were expected to make blocks but have only managed to make a couple, which is indicated by the luck factor. 100% luck means all blocks that were expected to be minted were minted. A luck of 0% means none, or hardly any blocks were minted. Even though that was expected.

Closing notes

I hope this page has been helpful in understanding how delegation to Stake Pools works and how this can make your ADA grow passively.

If you are looking for instructions on how to create your own wallet and the steps to take for delegating, I explain that here.

If you have any questions or would like to know more, please reach out to me on twitter: @weebl2000